Ease My Process.

Your Business Growth Partner Inventing Your Growth Strategy

Need Funding?

Want Financial Control?

Did you know 82% Of start-ups fail due to poor financial management? Let our team help you in achieve financial success.

Quality Assurance

Trusted by

Top firms

Client Satisfaction

98%

Approval rate

75% increase in deal closures

with our investor ready

pitch-deck and financial models

Process efficiency

save upto

60%

Expert Team

Led by

Experienced platforms

Services

Client served

by our core team members

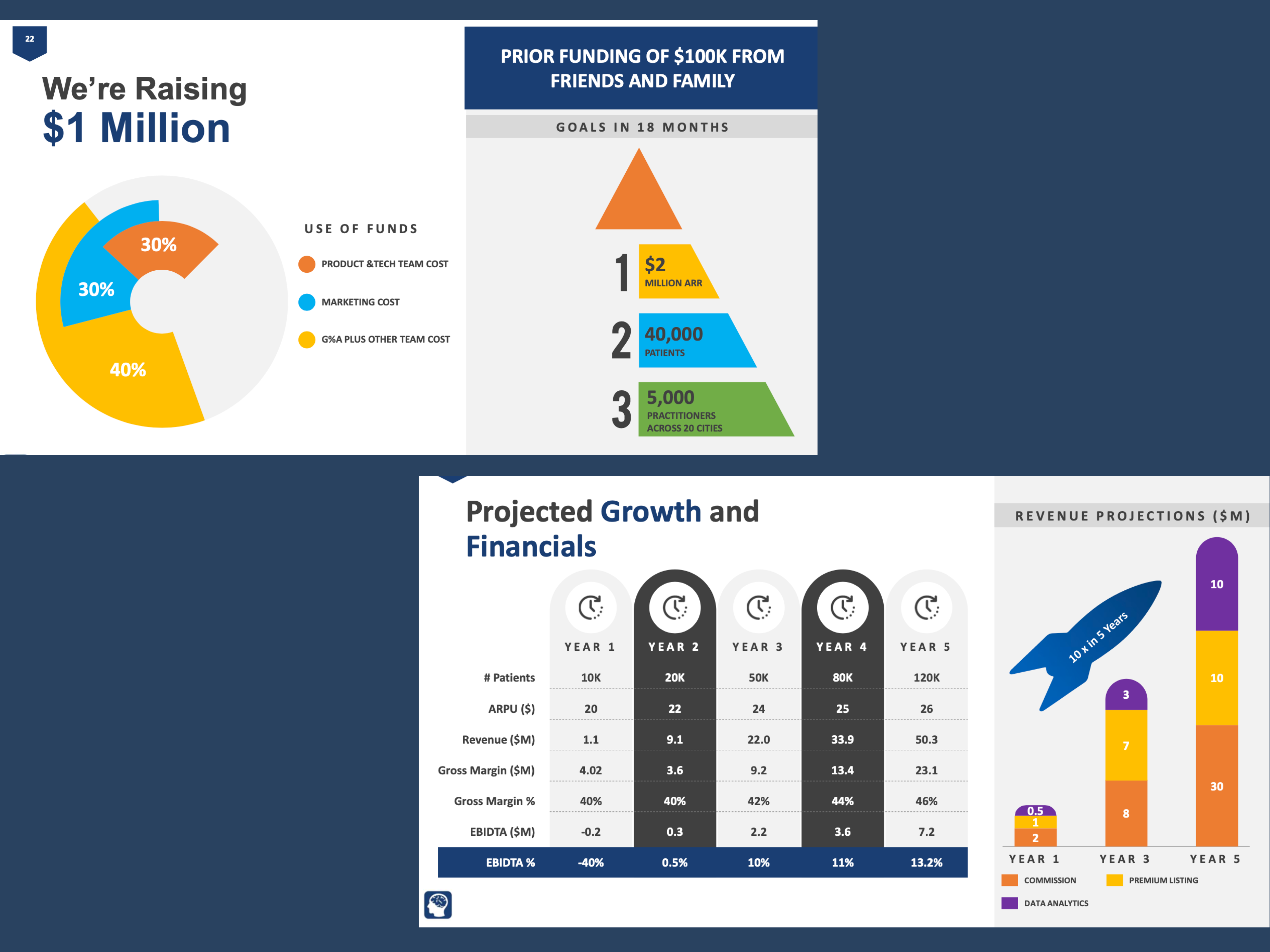

Our Portfolio

Business Valuation

Financial Modeling

Financial Planning & Analysis

Pitch deck

FAQs

Besides TAM/SAM/SOM, what other market sizing metrics are important?

Other sizing metrics are:

● Customer Acquisition Cost (CAC): The cost of acquiring a new customer, which helps understand the efficiency of your marketing efforts.

• CAC Formula: CAC = Total Customer Acquisition Costs / Number of Customers Acquired.

• Example: If your company spends ₹100,000 on marketing to acquire 100 new customers, your CAC would be ₹1,000.

● Customer Lifetime Value (CLTV): Represents the total revenue a customer generates throughout their relationship with your business.

• CLTV Formula: CLTV = Average Revenue per User (ARPU) x Average Customer Lifespan.

• Example: If your ARPU is ₹500 per month, and the average customer stays with you for 2 years (24 months), your CLTV would be ₹12,000.

● Market Share: Reflects your company's portion of the total market compared to competitors.

• Market Share Formula: Market Share = Your Company's Revenue / Total Market Revenue.

• Example: If your company generates ₹1 million in revenue in a month, and the total market revenue for your industry is ₹10 million, your market share would be 10%.

● Customer Acquisition Rate (CAR): Indicates the rate at which you acquire new customers over a specific period.

● Average Revenue Per User (ARPU): Represents the average revenue generated from each customer over a specific period.

● Customer Acquisition Cost (CAC): The cost of acquiring a new customer, which helps understand the efficiency of your marketing efforts.

• CAC Formula: CAC = Total Customer Acquisition Costs / Number of Customers Acquired.

• Example: If your company spends ₹100,000 on marketing to acquire 100 new customers, your CAC would be ₹1,000.

● Customer Lifetime Value (CLTV): Represents the total revenue a customer generates throughout their relationship with your business.

• CLTV Formula: CLTV = Average Revenue per User (ARPU) x Average Customer Lifespan.

• Example: If your ARPU is ₹500 per month, and the average customer stays with you for 2 years (24 months), your CLTV would be ₹12,000.

● Market Share: Reflects your company's portion of the total market compared to competitors.

• Market Share Formula: Market Share = Your Company's Revenue / Total Market Revenue.

• Example: If your company generates ₹1 million in revenue in a month, and the total market revenue for your industry is ₹10 million, your market share would be 10%.

● Customer Acquisition Rate (CAR): Indicates the rate at which you acquire new customers over a specific period.

● Average Revenue Per User (ARPU): Represents the average revenue generated from each customer over a specific period.

What does 'investor readiness' mean, and why is it crucial before seeking funding?

Being 'investor-ready' means your startup is prepared to attract investment. It involves having a solid business plan, clear financials, a well-defined market opportunity, and a strong team. This demonstrates professionalism and increases your chances of success.

What's the best way to track my startup's burn rate?

Best ways to track are:

● Burn rate: A crucial metric for startups. It measures the rate at which a company is depleting its cash reserves to fund operations.

● Gross Burn Rate: Total operating expenses over a specific period.

● Net Burn Rate: Total cash outflows minus cash inflows. Example: If a startup has ₹200,000 in monthly expenses and generates ₹50,000 in monthly revenue, the gross burn rate would be ₹200,000, and the net burn rate would be ₹150,000.

● Burn rate: A crucial metric for startups. It measures the rate at which a company is depleting its cash reserves to fund operations.

● Gross Burn Rate: Total operating expenses over a specific period.

● Net Burn Rate: Total cash outflows minus cash inflows. Example: If a startup has ₹200,000 in monthly expenses and generates ₹50,000 in monthly revenue, the gross burn rate would be ₹200,000, and the net burn rate would be ₹150,000.

What essential documents should a business have prepared when seeking funding from investors or venture capital firms?

Essential Documents are:

● Executive Summary: A concise overview of your business, product, and market.

● Business Plan: A detailed roadmap outlining your strategy and financials.

● Pitch Deck: A presentation summarizing your business for investors.

● Financial Statements: Audited financials or well-constructed projections.

● Legal Documents: Incorporation documents, capitalization table, etc.

● Executive Summary: A concise overview of your business, product, and market.

● Business Plan: A detailed roadmap outlining your strategy and financials.

● Pitch Deck: A presentation summarizing your business for investors.

● Financial Statements: Audited financials or well-constructed projections.

● Legal Documents: Incorporation documents, capitalization table, etc.

What types of questions do investors typically ask during due diligence?

The investors asks for these question:

● Market Opportunity: Investors will assess the size and potential of your target market.

● Product/Service: They'll evaluate your product's uniqueness and roadmap.

● Financial Projections: They will scrutinize your revenue model and burn rate.

● Team Expertise: They'll ask about your team's capabilities and experience.

● Go-to-Market Strategy: Investors want to understand how you'll acquire customers.

● Market Opportunity: Investors will assess the size and potential of your target market.

● Product/Service: They'll evaluate your product's uniqueness and roadmap.

● Financial Projections: They will scrutinize your revenue model and burn rate.

● Team Expertise: They'll ask about your team's capabilities and experience.

● Go-to-Market Strategy: Investors want to understand how you'll acquire customers.

What matters the most in a pitch deck or essentials of a pitch deck?

A successful pitch deck tells a compelling story about your business. It should include:

●Your logo, vision, and mission

●The problem you're solving

●Your solution and how it works

●Market analysis and competitive landscape

●Your team and business model

●Your financial projections and funding requirements

●Your logo, vision, and mission

●The problem you're solving

●Your solution and how it works

●Market analysis and competitive landscape

●Your team and business model

●Your financial projections and funding requirements